As prevailing economic systems fuel inequality, billionaire power and environmental destruction, it's time to ask: what if there were a better way? Reclaim the Economy Week begins to answer that question by highlighting, celebrating and co-creating alternatives around the globe.

Reclaim the Economy Week is a global week of action calling for economic systems that put people and the planet first. From 26 January to 1 February 2026, communities, organisations, and individuals around the world will come together to demand economic models grounded in dignity, fairness, ecological wellbeing and life-centric values.

This decentralised week invites events, campaigns and actions framed through diverse lenses - from Indigenous and rights-based economics to degrowth, doughnut economics, and wellbeing economies. There are resources and ideas to help groups and individuals to get involved and build power from the ground up. From Puerto Rico to Brazil to South Africa, communities around the world are planning actions and events to mark the week - find a map of the planned activities here.

A 2024 Earth4All survey found that over two thirds of people surveyed in 17 G20 countries agree that the way the economy works should prioritise the health and wellbeing of people and nature rather than focusing solely on profit and increasing wealth, while 62% agree that a country's economic success should be measured by the health and wellbeing of its citizens, not how fast the economy is growing. It is clear that appetite for better economies in service of life and wellbeing is strong, and Reclaim the Economy Week meets the moment by both calling for systems change and showcasing the alternatives already in motion around the world.

The week kicks off with an interactive online launch event on 26 January, bringing together voices from across movements to explore how we can reclaim the economy from growing inequality, environmental breakdown and concentrated corporate power. Participants will gain practical insights into alternative economic models, community-led solutions, and how to take action locally and globally.

Learn more and find out how to get involved at reclaimtheeconomy.org and sign up for the newsletter to stay updated on events and resources. The week is co-convened by Earth4All and the Wellbeing Economy Alliance.

The post Reclaim the economy week is coming appeared first on Club of Rome.

The Club of Rome is currently accepting applications for its Communications Fellowship 2026. The fellowship is a seven-month mentoring programme aimed at increasing the diversity of voices covering sustainability issues and supporting early-career communications professionals from Most of the World: Africa, Latin America and the Caribbean, Middle East and Asia-Pacific. The fellowship will be a remote placement with the successful fellow working from their home environment and with one trip to meet members of the Club of Rome team. The fellowship offers a modest stipend towards living costs and includes work-related travel costs.

The communications fellow will gain experience in communicating complex systems thinking for non-specialist audiences through a variety of platforms including the website, multimedia and social media. The successful candidate will work directly with the communications team, assisting with a variety of tasks including web publishing, preparing media outreach materials, event coverage, multimedia, social media and other communication activities.

There are two positions available, and we welcome applications from candidates with a diverse range of experience, we are particularly looking for individuals who enjoy working across all communication channels, and those who are skilled in producing multimedia content.

The ideal candidate will have:- A bachelor's or equivalent degree in science or journalism, and/or current student or graduate of a science journalism program.

- Some experience in writing about systems thinking or sustainability research for non-specialist audiences via blogs, newspapers, university websites or other outlets OR experience in producing multimedia content on relevant topics.

- Written and oral fluency in English and a proven ability to understand complex scientific research or systems thinking.

- Experience with, or interest in, social media, video, photography or other multimedia.

- Alignment with the beliefs and vision of the Club of Rome.

Bearing in mind the objectives of this fellowship, only applications from residents of countries in Most of the World (Africa, Latin America and the Caribbean, Middle East and Asia-Pacific) will be considered.

Learn more about current and past fellows here.

Applications:To apply, please fill out this application form.

Note on AI: Your application will be read and reviewed by humans - members of the Club of Rome communications team. While we understand that AI tools such as ChatGPT may be useful in preparing your applications, remember that in evaluating you as a potential Communications Fellow we will want to hear your authentic voice and style, so we encourage you to bring these across in your application.

While you are welcome to attach links to complete portfolios, please select one writing or multimedia sample that you feel is the most relevant for your application.

The application deadline is 20 February 2026 23:59 CET. Due to the high number of applications received, incomplete applications, applications not in English and applications received after the deadline will not be considered.

There is a modest stipend dependent on location for the seven-month fellowship, working Monday to Friday, 36 hours per week and includes 10 days paid leave. The fellowship will run from 1 July 2026 to 31 January 2027.

APPLY NOW About The Club of RomeThe Club of Rome is a unique platform of over 150 thought leaders and changemakers from across geographies and sectors, catalysing system change since 1968. Our vision is a world that has moved beyond emergencies, with reimagined systems that support human capacities to deliver wellbeing for all on a peaceful and healthy planet.

For general information about the organisation and its activities, please visit the Club of Rome website.

The post The Club of Rome Communications Fellowship Programme appeared first on Club of Rome.

The Club of Rome, in partnership with the European Investment Bank (EIB) Institute, has released a new report highlighting how finance can unlock the transformative innovation required to ensure Europe's competitiveness in a rapidly changing global landscape.

As the EU seeks to strengthen its competitiveness and accelerate breakthrough innovation, Rewiring finance for transformative innovation argues that Europe cannot rely on financing incremental fixes and short-term gains to address the deep technological, social and ecological transitions now underway. By reframing innovation through a systemic lens - to include new business models, governance structures and cultural narratives - the report offers a new perspective on the EU's competitiveness agenda and calls for finance to champion transformative, mission-driven innovation across the continent.

The report draws on insights from a series of high-level dialogues convened by the Club of Rome and the EIB Institute, bringing together thought leaders, policymakers and financial practitioners from across Europe. Co-author Peter Blom, former CEO of Triodos Bank and member of the Club of Rome, said:

"Transformative innovation is essential if we are to respond meaningfully to today's interconnected crises. This report shows that finance can be a powerful catalyst and enabler for the kinds of breakthroughs that shift entire systems, not just improve them at the margins. By aligning financial decisions with long-term societal and planetary impact, we can unlock innovations that ensure a thriving future for all."

Aligning finance with transformative innovationThe report emphasises that while sustainable finance has grown, financial systems remain largely misaligned with the ambition of transformative innovation. Short-term risk models, fragmented funding streams and a lack of hybrid solutions continue to hinder innovations that could reshape Europe's strategic sectors - whether in clean energy, circular materials, food systems or nature-based solutions.

To realign finance with transformation, the report identifies five interrelated pathways for change:

- Prioritising impact and mission: Placing long-term public value at the heart of financial mandates and investment decisions.

- Building internal capacity for innovation: Equipping financial institutions with the skills and systems thinking needed to assess and support complex, cross-sector transitions.

- Embracing risk and uncertainty: Developing forward-looking frameworks that enable experimentation and high-impact investment.

- Full-spectrum finance for the innovation lifecycle: Ensuring support across the innovation lifecycle, from early-stage ideas to large-scale deployment.

- Strengthening institutional capital ecosystems: Fostering collaboration between public and private actors to build coherent, mission-driven innovation ecosystems.

Through examples from institutions such as BBVA and Invest-NL, the report shows that elements of transformative finance are already emerging in practice. These pioneers demonstrate that that balancing impact, risk and return can unlock high-potential innovations essential to Europe's competitiveness and resilience.

A call for co-creationThe report calls for policymakers, financial leaders and civil society to co-create a financial system capable of enabling transformative innovation at scale. Finance must act not just as a source of capital, but as an active enabler of Europe's long-term strategic priorities.

Jean-Pierre Vidal, acting head of the EIB Institute, said: "The EIB Group plays a pivotal role in driving innovation across Europe by uniting public purpose with private initiative. This strengthens Europe's competitiveness in a lasting way and lays the foundations for sustainable growth and prosperity for the future."

This publication marks the culmination of this collaboration between the Club of Rome and the EIB Institute. Together, the two institutions have convened a community of practice exploring how public and private finance can be rewired to serve long-term societal wellbeing.

Sandrine Dixson-Declève, honorary president of the Club of Rome and co-author of the report, concluded: "Transformative innovation requires that we reshape the systems and values that govern our societies. To deliver real benefits for people, planet and prosperity, finance must prioritise solutions that build resilience and equity, not just short-term returns."

Download the reportThe post Rewiring finance: how a systemic approach can unlock transformative innovation in Europe appeared first on Club of Rome.

Storytelling has shaped humanity since the dawn of time, and today it may matter more than ever. For centuries, humans have used stories to explain the world, unite communities and imagine futures that do not yet exist. Yet in the digital age, storytelling has also become a battleground: narratives spread at unprecedented speed, influencing what people believe, how they act and whom they trust.

The 50 Percent has launched the 'Young person's guide to storytelling', a new resource created to help young people understand the power of stories in shaping society and how to use that power responsibly.

The guide offers a clear, accessible roadmap for understanding how stories shape public life and how young people can use storytelling to strengthen, rather than destabilise, democratic culture.

What the guide coversDrawing on research, real-world examples and youth perspectives, the guide explores:

- The power of storytelling

The guide shows how stories have always fuelled collective imagination, from early myths to modern media, and how this ability to craft meaning has given humans an evolutionary advantage. Storytelling helps people collaborate, organise, learn and solve problems.

- The dangers of storytelling

Stories can mislead, exclude or cause harm. The guide explains how narratives can oversimplify complex realities, manipulate emotions or create "heroes vs villains" frames that polarise communities.

- Misinformation, disinformation and democracy

The guide outlines how false or misleading stories spread online, often faster than accurate information. Algorithms amplify sensational content, social media accelerates emotional reactions and political actors weaponise narratives for influence.

It also highlights the consequences: declining trust in institutions, rising cynicism and young people increasingly unsure whether the information they see is real.

- Why young people are especially vulnerable

Despite being highly connected, research shows Gen Z is among the groups most susceptible to misinformation. Hyperconnected but overwhelmed, young people face a media environment that blurs fact and fiction, making it difficult to assess credibility, especially on platforms designed for speed, not accuracy.

- How young people can respond

The guide offers tools for spotting false narratives, understanding emotional manipulation and creating counter-narratives grounded in empathy, shared values and community connection.

It encourages young people not only to be critical consumers of media but also active storytellers who use their voice responsibly and creatively to shape a more hopeful future.

A call to actionAt a time when misinformation spreads faster than ever, and when many feel discouraged or excluded from political processes, the guide offers a refreshing alternative: rebuild trust, reconnect communities and tell better, braver, more human stories.

As the authors write, storytelling is not just a tool… it is a responsibility. And when young people take the lead, it becomes a force for collective healing and change.

The 'Young person's guide to storytelling' is now available for download: here.

Download the guideThe post Introducing the young person's guide to storytelling appeared first on Club of Rome.

From 22 to 24 September 2025, Belgrade hosted the World Conference on Science and Art for Sustainability, an event that united scientific and artistic communities from across the majority of the world to explore how science and art can jointly respond to today's interlinked global challenges.

It was the first conference of the Earth-Humanity Coalition (EHC) and the World Academy of Art and Science (WAAS) programme and a flagship milestone of the International Decade of Sciences for Sustainable Development (IDSSD) 2024-2033.

As founding members of the Earth-Humanity Coalition, The Club of Rome and The Fifth Element are partners of the International Decade of Sciences for Sustainable Development, working together to mobilise all sciences at the service of humanity and enable change in the coming decade.

The Belgrade Declaration: a call for integrative, ethical and pluriversal actionA key outcome of the conference, the declaration calls for a fundamental shift in how global crises are addressed. Developed from the conference debates, it urges the integration of scientific, artistic and traditional knowledge to confront the deep polycrisis facing humanity.

It highlights several central needs:

1. Systemic and multiple disciplinary responses

The declaration underscores that existential threats, including climate change, geopolitical fragmentation and the misuse of artificial intelligence, are deeply interdependent and cannot be solved through siloed approaches. It calls for scientific, artistic, social and humanistic knowledge to be integrated, and for stronger engagement with traditional and indigenous perspectives.

2. Closer cooperation between science and art

Science and art are presented as complementary ways of understanding humanity, nature and the universe. The declaration argues that deeper integration between them can strengthen societal awareness, inspire new paradigms and support the transformative shifts needed for peaceful ecological civilisations.

3. Renewed commitment to education and knowledge systems

Education should nurture curiosity, creativity and responsibility by connecting scientific, artistic and cultural knowledge. The declaration supports the creation of a 'worldwide grid of transdisciplinary hubs for sustainability', enabling collaboration from local to global levels.

4. Stronger support for science, art and education

Delegates emphasised the need to rebuild trust between decision-makers, scientists and artists, and to create new spaces for cooperation grounded in mutual respect. The declaration also calls for more inclusive, evidence-based scientific advice and for diplomacy to foster peaceful relations and shared commitment to sustainability. It stresses that the majority of the world must receive equal attention.

The declaration was written by Michel Spiro, from The Earth-Humanity Coalition, Garry Jacobs and Nebojša Nešković, from WAAS and The Club of Rome, Paul Shrivastava and Carlos Álvarez Pereira, from The Club of Rome, and Steven Hartman, from the UNESCO-MOST BRIDGES Coalition.

Outcome documents from the conference:- The Belgrade declaration on science and art for sustainability (mentioned above).

- The World Conference on Science and Art for Sustainability report, prepared by the World Academy of Art and Science (WAAS), highlights how the IDSSD aims to build regenerative and peaceful pathways grounded in human security, sustainability and planetary wellbeing.

- The interviews exploring 11 speakers' perspectives on global challenges, the role of science and art and the transformative ideas emerging from the conference, by Vesna de Vinča, a journalist, writer and producer from Belgrade.

The World Conference on Science and Art for Sustainability marks an important step forward in the International Decade of Sciences for Sustainable Development, reinforcing that science and art - working in concert with communities and institutions across regions - can help shape more peaceful, resilient and equitable futures.

The post Science and art unite to advance the International Decade of Sciences for Sustainable Development appeared first on Club of Rome.

There is no doubt about China's rise to the status of a global powerhouse, whether framed positively or not. China has emerged as the world's largest economy in terms of purchasing power parity, and the second largest by nominal GDP. It is considered the world's largest industrial, manufacturing and trading nation, with the world's largest middle class and the eradication of extreme poverty.

A new report to The Club of Rome, Understanding China: Governance, Socio-Economics, Global Influence, offers a balanced and objective perspective into China's meteoric rise from the late 1970s. The book lays out the model of governance in detail at the national, provincial and local levels, which provides a strong basis for understanding current dynamics, along with its strengths and weaknesses.

The book outlines the trajectory of China's development and the massive changes which have resulted within. It also outlines the implications the rise of China has and will have for the rest of the world in the future. It emphasises that the Chinese model and principles need not be adopted wholesale but serve as a valuable test case for countries seeking to pursue a similar developmental trajectory, especially with the commitment to lift hundreds of millions out of poverty.

"The economic and technological rise of China has proven to be both staggering in pace and inexorable in trajectory. This neither calls for mindless optimism and zealous embracing of all that the country has to offer," commented Chandran Nair, Founder, Global Institute for Tomorrow, member of the Club of Rome and lead author. "The Chinese government is steered by a deeply rooted and historically grounded devotion towards its people - one could even term this as a point of foundational fixation."

The book proposes seven working principles for the international community's engagement with China, which can shape sustainable, convivial and successful relations. Insights are drawn from both Chinese and international sources and build on the work of the Chinese Association of the Club of Rome (which was also founded by the report authors).

"There is more in common between China and other countries than separates them. We are all confronted by similar challenges. The Chinese government has advanced the notion of a "community of shared future for mankind" in full cognisance we are in an era of globalisation, therefore national interests cannot be carved out and compartmentalised in narrow silos," adds Nair.

Through the insights into China's internal strengths and challenges, its global influence and its unique governance model, the book encourages respectful dialogue and informed engagement. It is an essential resource for policymakers, business leaders, academics and students seeking clarity on China's past, present and future.

"We are well aware of the difficulties of writing a book about China that satisfies the diverse interests of the intended global audience. At all times the commitment has been to seek balance and to remain impartial," commented Jorgen Randers, Professor Emeritus, BI Norwegian Business School and member of the Club of Rome.

The book is a result of a deepening understanding of the role China plays globally and its publication follows a conference dedicated to Earth humanity reconciliation that was held in China from 5-7 November.

Order the book from RoutledgeThe post A pathway to understanding China appeared first on Club of Rome.

By 2070, segments of the southern hemisphere of the planet Earth will have 30 to 100% more population than today. The struggle for these youth needing to acquire skills to hold even minimal livelihoods needs strong educational transformation if this increase is to be a peaceful change, rather than one causing civil unrest within these regions. Importantly, inequity and injustice affecting people experiencing poverty, marginalisation or dispossession can be partially alleviated with meaningful education, which remains inaccessible to many, especially marginalised and Indigenous communities worldwide.

As a response to this problem, the South African Embassy in Rome and The Club of Rome (with support from the USA Association for The Club of Rome, the Canadian Association for The Club of Rome, and African members of The Club of Rome) have launched "Education for Hope", marking a defining moment for the global re-centring of education as a force for dignity, community and planetary regeneration.

The launch occurred on 30 October 2025, in Rome, within the Jubilee of the Vatican, in a week focused on education for pilgrims from schools and universities around the world, in the elegant Official Residence of H.E. Nosipho Nausca-Jean Jezile, Ambassador of the Republic of South Africa to Italy and Permanent Representative to FAO, IFAD and WFP.

From reflection to regeneration, linking two traditionsThe launch connected two key moral and intellectual traditions: the Ubuntu philosophy of Africa, affirming that "the village is the school", and The Club of Rome's enduring quest for human-centred transformation, from The Limits to Growth to The Fifth Element, consciousness as the integrating force for change.

In the same way that the report to The Club of Rome No Limits to Learning urged humanity to transcend reductionist and competitive systems of thought, "Education for Hope" extends this invitation into lived educational practice, linked to "No Limits to Hope".

No Limits to Learning foresaw that humanity's survival would depend not only on technological progress, but on our capacity to learn at higher levels of consciousness. Education for Hope is that learning embodied, it turns cognitive insight into collective practice, analysis into action and interdependence into education.

In other words, if No Limits to Learning described the mental and systemic awakening needed for planetary stewardship, "No Limits to Hope" embodies the moral and communal awakening needed to live it. Together, they form The Fifth Element, the fusion of head, heart, hands, heritage and humanity, which the Education for Hope delegation presented in Rome as the living pedagogy of Ubuntu.

Education as The Fifth ElementThe Fifth Element, as articulated by The Club of Rome, represents a synergy of consciousness, compassion and systemic renewal. Education for Hope translates this into the language of daily life, teaching that learning and being are inseparable, and that true knowledge is not only cognitive but relational, moral and ecological.

Mamphela Ramphele, Honorary President of The Club of Rome (2018-2023) and Patron of Education for Hope, captured this integration when she said, "Education is an act of love, of freedom and of hope, the engine of possible change." In her inaugural address at the meeting.

Her words resonated as The Fifth Element itself, the human spirit in motion, transforming consciousness into community, and knowledge into justice.

The launching of Education for Hope

Re-imagining learning through UbuntuRooted in Ubuntu, I am because we are, Education for Hope reframes education as a communal act of healing and co-creation. It is not a programme or policy but a living social movement emerging from the majority of the world and speaking to humanity, that education must once again make us more human, not more competitive.

The movement's collaboration with The Club of Rome reflects a deep alignment:

- Both call for integral approaches that connect social justice, ecological stewardship and human consciousness.

- Both envision education as the foundation of a regenerative civilisation, one that honours life's interdependence and the wisdom of communities.

- Both insist that hope is a discipline, a practical act of courage grounded in compassion.

In the same week as the launch, the delegation of twelve members from eight nations (South Africa, Mexico, Chile, Argentina, Aruba, Japan, the USA, and Canada), also participated in the Vatican Educational Jubilee events at the Dicastery for Culture and Education's Scientific Committee. They were honoured to assist in re-shaping the renewal of the Global Compact on Education, released at the event, expanding its vision to include inner life, digital humanism and peace as a lived pedagogy. .

By affirming Ubuntu as a guiding ethical foundation, the delegation ensured that most of the world, often the cradle of spiritual and ecological wisdom, now stands as a co-author of the renewed Compact.

The Dicastery meeting with Father E. Bono of the Vatican Dicastery of Education and Culture

A pact of the heart for the planetAt its heart, Education for Hope is a pact of the heart, a shared commitment to rebuild the moral, ecological and spiritual fabric of education. It invites educators, students and institutions to form constellations of hope, learning communities that live The Fifth Element through dialogue, service and reflection.

The collaboration between The Club of Rome, the South African Embassy, and the Education for Hope movement demonstrates that the future of learning will not be found in curricula or technology alone, but in relationships of care, communities of purpose and education as the most powerful act of hope.

Find out more about the project: https://educationforhope.org.za/

If you want to get involved or financially support the project, contact jgilmour@leapinstitute.org.za or athorhaug@msn.com.

The post Launch of Education for Hope: From No Limits to Learning to No Limits to Hope appeared first on Club of Rome.

Ahead of the critical climate summit in Belém, a new report from Earth4All argues that Brazil's greatest assets in tackling the climate crisis are not only its vast forests and renewable energy potential, but the power of trust and social cohesion.

The study, Earth4All: Brazil, identifies possible future scenarios for the country and shows that policies promoting fairness, inclusion and institutional trust are decisive for accelerating decarbonisation and building resilience. Without them, progress risks stalling in the face of inequality and social division.

"Our analysis shows that when trust and fairness increase, public resistance to change falls," said Sandrine Dixson-Declève, executive chair of Earth4All. "This enables faster reforms and ultimately delivers stronger climate outcomes."

Drawing on system dynamics modelling and input from a commission of national and international experts, the report explores how coordinated reforms or "extraordinary turnarounds" across five areas - poverty, inequality, empowerment, food, and energy - can deliver both climate stability and shared prosperity. It concludes that ambitious domestic action, aligned with global efforts, could eradicate poverty in Brazil before 2040, expand renewable energy, and strengthen Brazil's capacity to withstand future shocks.

Its findings align with those of the global Earth4All analysis, published in Earth for All: A Survival Guide for Humanity in 2022, and subsequent national analyses showing that ambitious action targeted to specific geographical challenges can deliver economic wellbeing and resilience to future shocks and stresses.

The report includes data from a major global survey, conducted for Earth4All by Ipsos which included Brazil, that reveals a powerful mandate for change: 81% of Brazilians say major action is needed this decade to protect the climate and nature, yet only 35% believe their government is doing enough. 76% agree that there is too much inequality in the country. The report recommends policies such as progressive wealth and ecological taxes, a climate-poverty sovereign wealth fund co-governed by marginalised communities, and conditional rural credit tied to verified sustainability criteria.

The "Giant Leap" scenario identified by the report - featuring strong national and global action - shows Brazil transforming into a renewable energy powerhouse, restoring degraded lands, and reducing inequality through inclusive governance. The "Too Little Too Late" scenario of incremental action, by contrast, would lock in higher emissions, deepen social tensions, and weaken democratic trust.

The study also calls on Brazil to champion a Global Climate and Nature Council to coordinate global responses to ecological tipping points, aligning with the COP30 Presidency's push for integrated climate-nature governance.

"We asked: if we know the solutions, why are we not making progress on climate? Our analysis across the globe increasingly shows that trust and fairness are not peripheral to climate policy - they are the foundations of it," said Dixson-Declève. "By implementing five extraordinary turnarounds adapted to Brazil's needs, Brazil can build a model of inclusive transition that unites environmental ambition with social justice and inspire other countries. COP30 is a decisive moment for setting the course of long-term action and Brazil can use this opportunity to show real leadership on the interlinked issues of climate, social equity and wellbeing."

Download the reportCarlos Nobre, co-chair of the Science Panel for the Amazon and chair of the Earth4All Brazil Transformational Economics and Planetary Sciences Commission, said: "The findings of this report are refreshingly straightforward: climate stability, social cohesion and shared prosperity rise or fall together. Push one without the others and progress stalls. Advance them together and Brazil can unlock a step-change in emissions reduction, environmental protection to avoid biomes' tipping points, economic competitiveness, fiscal stability and human flourishing."

The post Trust and fairness are Brazil's most powerful climate tools, finds new Earth4All analysis ahead of COP30 appeared first on Club of Rome.

This is the first publication of The Fifth Element's discussion paper series.

Introducing: Dancing with paradigms, could systemic wisdom emerge?

Rethinking how we change systems"There is yet one leverage point that is even higher than changing a paradigm. That is to keep oneself unattached in the arena of paradigms, to stay flexible, to realize that no paradigm is "true", that everyone, including the one that sweetly shapes your own worldview, is a tremendously limited understanding of an immense and amazing universe that is far beyond human comprehension."

- Donella Meadows

The world is complex, and the challenges we face - climate disruption, social inequality, and fractured governance - cannot be solved by the systems that shaped modernity. Economic, political, and technological structures are often inadequate, and sometimes they drive the crises themselves. Meanwhile, knowledge is fragmented: business, politics, academia, and activism each operate in their own bubbles, with little connection between them. This separation locks us into patterns that make change difficult.

The challenge now is not just to act, but to rethink what we mean by systems change. Rather than searching for one grand theory, we must learn to weave together different approaches and worldviews. This integrative approach, holding complexity without reducing it to simple answers, builds on the legacy of No Limits to Learning, published by The Club of Rome in 1979.

Dancing with paradigmsDonella Meadows, author of Leverage Points: Places to Intervene in a System (1999), spoke of the highest leverage point: "the power to transcend paradigms." In other words, recognising that no single worldview is absolute and that every paradigm is only a partial understanding of a vast, complex universe.

This is not a comfortable place to be. Humans crave certainty. But it is where The Club of Rome sees its role: embracing plurality, fostering dialogue across divides, and supporting cultural and systemic renewal. Meadows' last publication was titled Dancing with Systems. Today, The Club of Rome extends that spirit to "dancing with paradigms."

Introducing the discussion paper seriesThis is the essence of The Fifth Element, The Club of Rome's programme dedicated to deep learning and mutual transformation. To advance this work, we are launching a new discussion paper series. Each paper is an invitation, an open exploration rather than a final answer.

Our first paper sets the tone. It argues that transformation begins with asking better questions, not rushing to solutions. Some questions are not meant to be "solved" but lived. The paper explores questions too often overlooked, for example:

- How do we navigate the divide between "us" and "them"?

- How can we move from a focus on capital to the long-term value of heritage?

- What does regenerative thinking mean for society, economy, and the planet?

It also introduces key threads of our inquiry, including intergenerational leadership, regenerative business, pluriversal worldviews, and shifting cultural meanings.

For anyone interested in how societies can move from fragmented systems to coherent, regenerative networks, the paper offers both insight and inspiration. It invites readers to explore the deeper questions of systemic change and contribute to shaping pathways that reconnect humanity with the natural world.

Read the full discussion paper here.

Download the reportAre you an expert or an organisation working on topics related to systems transformation? Do you want to share your perspective? The Fifth Element's looking for content to share on their opinions page. Check the submission guidelines.

The post An integrative approach towards Earth-Humanity reconciliation appeared first on Club of Rome.

An expert group has urged the European Commission to cut Europe's resource use and introduce binding demand reduction targets to secure the bloc's future prosperity and resilience.

In its response to the Commission's public consultation on the Circular Economy Act, the Taskforce on Materials and Consumption are calling for the Commission to adopt a demand-focused approach to the management of critical resources. At a time of growing geopolitical and economic pressures, the group argues that cutting demand for natural resources is essential not only to meet climate and nature goals, but also to strengthen Europe's competitiveness and security.

The briefing, titled Securing Europe's Future through a Just & Competitive Circular Economy, sets out three key recommendations for the Circular Economy Act:

- Establish material footprint targets: Set EU-wide material footprint reduction targets by 2028 to ensure resource use stays within planetary boundaries.

- Prioritise resource efficiency of key provisioning systems: Shift from recycling and product-based strategies to investment in the transformation of housing, food, mobility and energy systems - responsible for an estimated 90% of global material use.

- Champion international governance for resource use: To address rising geopolitical tensions and growing global uncertainty, the EU should champion a fair, transparent, and rules-based global governance framework for resource use, ensuring a just transition globally.

While recognising existing EU efforts, the Taskforce warns that without ambitious policies that fundamentally reset the priorities and direction of the economy, the EU risks missing its climate targets and forfeiting opportunities for innovation, competitiveness, and social equity.

"Current EU policy has laid important groundwork, but it remains fragmented and overly focused on recycling and waste management. Without addressing material demand and system-level drivers of resource use, the transformation to a truly regenerative circular economy will remain incomplete," said taskforce co-chair Anders Wijkman, Honorary President of The Club of Rome.

The experts highlight that material extraction and processing are responsible for over 90% of land-related biodiversity loss and more than half of global greenhouse gas emissions. Europe - which currently imports more than twice the weight of materials than it exports - has a strategic interest in reducing its resource dependency while ensuring its economic model is compatible with climate goals.

Download the submission"We have now had over 10 years of lessons about what does not work regarding the circular economy as it is currently being implemented. The upcoming Circular Economy Act is an opportunity to get it right, and for the EU to pioneer a truly innovative approach to resource management," said co-chair Lewis Akenji, executive director of the Hot or Cool Institute. "By embedding material footprint targets and a justice-based approach to resource governance in its strategy, Europe can set a global precedent for how to achieve prosperity and citizen wellbeing within planetary boundaries."

The post Expert taskforce calls for binding resource targets in EU Circular Economy Act to secure Europe's future appeared first on Club of Rome.

The supply and demand model of economists suggests that oil prices might rise to consistently high levels, but this has not happened yet:

Figure 1. Average annual Brent equivalent inflation-adjusted crude oil prices, based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute. The last year shown is 2024.

Figure 1. Average annual Brent equivalent inflation-adjusted crude oil prices, based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute. The last year shown is 2024.

In my view, the economists’ model of supply and demand is overly simple; its usefulness is limited to understanding short-term shifts in oil prices. The supply and demand model of economists does not consider the interconnected nature of the world economy. Every part of GDP requires energy consumption of some type. The price issue is basically a physics issue because the world economy operates under the laws of physics.

In this post, I will try to explain what really happens when oil supply is constrained.

[1] Overview: Why Oil Prices Don’t Permanently Rise; What Happens InsteadMy analysis indicates that there are three ways that long-term crude oil prices are held down:

(a) Growing wage and wealth disparities act to reduce the “demand” for oil. As wage and wealth disparities widen, the economy heads in the direction of a shrinking middle class. With the shrinking of the middle class, it becomes impossible to bid up oil prices because there are too few people who can afford their own private cars, long distance travel, and other luxury uses of oil. Strangely enough, this dynamic is a major source of sluggish growth in oil demand.

(b) Politicians work to prevent inflation. Oil is extensively used in food production and transport. If crude oil prices rise, food prices also tend to rise, making citizens unhappy. In fact, inflation in general is likely to rise, as it did in the 1970s. Politicians will use any method available to keep crude oil prices down because they don’t want to be voted out of office.

(c) In very oil deficient locations, such as California and Western Europe, politicians use high taxes to raise the prices of oil products, such as gasoline and diesel. These high prices don’t get back to the producers of crude oil because they are used directly where they are collected, or they act to subsidize renewables. My analysis suggests that indirectly this approach will tend to reduce world crude oil demand and prices. Thus, these high taxes will help prevent inflation, especially outside the areas with the high taxes on oil products.

Instead of oil prices rising to a high level, I expect that the methods used to try to work around oil limits will lead to fragility in many parts of the economic system. The financial system and international trade are particularly at risk. Ultimately, collapse over a period of years seems likely.

Underlying this analysis is the fact that, in physics terms, the world economy is a dissipative structure. For more information on this subject, see my post, The Physics of Energy and the Economy.

[2] Demand for oil is something that tends not to be well understood. To achieve growing demand, an expanding middle class of workers is very helpful.Growing demand for oil doesn’t just come from more babies being born each year. Somehow, the population needs to buy this oil. People cannot simply drive up to a gasoline station and honk their horns and “demand” more oil. They need to be able to afford to drive a car and purchase the fuel it uses.

As another example, switching from a diet which reserves meat products for special holidays to one that uses meat products more extensively tends to require more oil consumption. For this type of demand to rise, there needs to be a growing middle class of workers who can afford a diet with more meat in it.

These are just two examples of how a growing middle class will tend to increase the demand for oil products. Giving $1 billion more to a billionaire does not have the same impact on oil demand. For one thing, a billionaire cannot eat much more than three meals a day. Also, the number of vehicles they can drive are limited. They will spend their extra $1 billion on purchases such as shares of stock or consultations with advisors on tax avoidance strategies.

[3] In the US, there was a growing middle class between World War II and 1970, but more recently, increasing wage and wealth disparities have become problems.There are several ways of seeing how the distribution of income has changed.

Figure 2. U. S. Income Shares of Top 1% and Top 0.1%, Wikipedia exhibit by Piketty and Saez.

Figure 2. U. S. Income Shares of Top 1% and Top 0.1%, Wikipedia exhibit by Piketty and Saez.

Figure 2 shows an analysis of how income (including capital gains) has been split between the very rich and everyone else. What we don’t see in Figure 2 is the fact that total income (calculated in this way) has tended to rise in all these periods.

Back in the 1920s (known as “the roaring 20s”), income was split very unevenly. There was a substantial share of very wealthy individuals. This gradually changed, with ordinary workers getting more of the total growing output of the economy. The share of the economy that the top earners obtained hit a low in the early 1970s. Thus, there were more funds available to the middle class than in more recent years.

Another way of seeing the problem of fewer funds going to ordinary wage earners is by analyzing wages and salary payments as a share of US GDP.

Figure 3. Wages and salaries as share of US GDP, based on data of the US Bureau of Economic Analysis.

Figure 3. Wages and salaries as share of US GDP, based on data of the US Bureau of Economic Analysis.

Figure 3 shows that wages and salaries as a percentage of GDP held up well between 1944 and 1970, but they have been falling since that time.

Furthermore, we all can see increasing evidence that young people are not doing as well financially as their parents did at the same age. They are not as likely to be able to afford to buy a home at a young age. They often have more college debt to repay. They are less able to buy a vehicle than their parents. They are struggling to find jobs that pay well enough to cover all their expenses. All these issues tend to hold down oil demand.

Since 1981, falling interest rates (shown in Figure 6, below) have allowed growing wage disparities to be transformed into growing wealth disparities. This has happened because long-term interest rates have fallen over most of this period. With lower interest rates, the monthly cost of asset ownership has fallen, making these assets more affordable. High-income individuals have disproportionately been able to benefit from the rising prices of assets (such as homes and shares of stock), because with higher disposable incomes, they are more able to afford such purchases. As a result, since 1981, wealth disparity has tended to increase as wage disparity has increased.

[4] Governments talk about the growing productivity of workers. In theory, this growing productivity should act to raise the wages of workers. This would maintain the buying power of the middle class. Figure 4. Productivity growth by quarter, relative to productivity in the similar quarter one year earlier, based on data of the Bureau of Labor Statistics, as recorded by the Federal Reserve of St. Louis in its data base. The last quarter shown ends June 30, 2025.

Figure 4. Productivity growth by quarter, relative to productivity in the similar quarter one year earlier, based on data of the Bureau of Labor Statistics, as recorded by the Federal Reserve of St. Louis in its data base. The last quarter shown ends June 30, 2025.

Figure 4 shows that productivity growth was significantly higher in the period between 1948 and 1970 than in subsequent years. Figure 2 shows that before 1970, at least part of the productivity growth acted to raise the incomes of workers. More recently, productivity growth has been lower. With this lower productivity growth, Figure 2 shows that wage-earners are especially being squeezed out of productivity gains. It appears that most of the growth attributable to productivity gains is now going to other parts of the economy, such as the very rich, the financial sector, and the governmental services sector.

The changes the world has seen since 1970 are in the direction of greater complexity. Adding complexity tends to lead to growing wage and wealth disparities. Figure 4 seems to indicate that with added complexity, productivity per worker still seems to rise, but not as much as when the economic system grew primarily due to growing fossil fuel usage leveraging the productivity of workers.

Figure 4 shows data through June 30, 2025. Note that productivity in the latest period is lower than in earlier periods, even with the early usage of Artificial Intelligence. This is a worrying situation.

[5] The second major issue holding oil prices down is the fact that if crude oil prices rise, food prices also tend to rise. In fact, overall inflation tends to escalate.Oil is extensively used in food production. Diesel is used to operate nearly all large farm machinery. Vehicles used to transport food from fields to stores use some form of oil, often diesel. Transport vehicles for food often provide refrigeration, as well. International transport, by jet or by boat also uses oil. Companies making hybrid seeds use oil products in their processes and distribution.

Furthermore, even apart from burning oil products, the chemical qualities of petroleum are used at many points in food production. The production of nitrogen fertilizer often uses natural gas. Herbicides and insecticides are made with petroleum products.

Because of these considerations, if oil prices rise, the cost of producing food and transporting it to its destination will rise. In fact, the cost of transporting all goods will rise. These dynamics will tend to lead to inflation throughout the system. When oil prices first spiked in the 1970s, inflation was very much of an issue, both for food and for goods in general. No one wants a repetition of a highly inflationary scenario.

Politicians will be voted out of office if a repetition of the oil price spikes of the 1970s takes place. As a result, politicians have an incentive to hold oil prices down.

[6] Oil prices that are either too high for the consumer or too low for the producer will bring the economy down.We just noted in Section [6] that oil consumers do not want the price of oil to be too high. There are multiple reasons why oil producers don’t want oil prices to be too low, either.

A basic issue is that the cost of oil production tends to rise over time because the easiest to extract oil is produced first. This dynamic leads to a need for higher prices over time, whether or not such higher prices actually occur. If prices are chronically too low, oil producers will quit.

A second issue is the fact that many oil exporting countries depend heavily on the tax revenue that can be collected from exported oil. OPEC countries often have large populations with very low incomes. Oil prices need to be high enough to provide food subsidies for an ever-growing population of poor citizens in these countries, or the leaders will be overthrown.

Figure 5. OPEC Fiscal Breakeven prices from 2014, published by APICORP.

Figure 5. OPEC Fiscal Breakeven prices from 2014, published by APICORP.

Figure 5 shows required breakeven prices for oil producers in the year 2014, considering their need for tax revenue to support their populations, in addition to the direct costs of production. The current Brent Oil price is only about $66 per barrel. If the breakeven price remains at the level shown in 2014, this price is too low for every country listed except Qatar and Kuwait.

No oil exporting country will point out these price problems directly, but they will tend to cut off oil production to try to get oil prices up. In the recent past, this has been the strategy.

OPEC can also try a very different strategy, trying to get rid of competition by temporarily dumping stored-up oil onto the market, to lower oil prices to try to harm the financial results of its export competition. This seems to be OPEC’s current strategy. OPEC knows that US shale producers are now near the edge of cutting back greatly because depletion is raising their costs and reducing output. OPEC hopes that by obtaining lower prices (such as the $66 per barrel current price), it can push US shale producers out more quickly. As a result, OPEC hopes that oil prices will rebound and help them out with their price needs.

I have had telephone discussions with a former Saudi Aramco insider. He claimed that OPEC’s spare capacity is largely a myth, made possible by huge storage capacity for already pumped oil. It is also well known that OPEC’s (unaudited) oil reserves appear to be vastly overstated. These myths make the OPEC nations appear more powerful than they really are. OECD nations, with a desire for a happily ever after ending to our current oil problems, have eagerly accepted both myths.

To extract substantially more oil, the types of oil that are currently too expensive to extract (such as very heavy oil and tight oil located under metropolitan areas) would likely need to be developed. To do this, crude oil prices would likely need to rise to a much higher level, such as $200 or $300 per barrel, and stay there. Such a high price would lead to stratospherically higher food prices. It is hard to imagine such a steep rise in oil prices happening.

[7] The third major issue is that politicians in very oil deficient areas have been raising oil prices for consumers through carbon taxes, other taxes, and regulations.Strangely enough, in places where the lack of oil supply is extreme, politicians follow an approach that seems to be aimed at reducing what little oil supply still exists. In this approach, politicians charge high taxes (“carbon” and other types) on oil products purchased by consumers, such as gasoline and diesel. They also implement stringent regulations that raise the cost of producing end products from crude oil. California and many countries in Western Europe seem to be following this approach.

With this approach, taxes and regulations of many kinds raise oil prices paid by customers, forcing the customer to economize. Some of the money raised by these taxes may go to help subsidize renewables, but virtually none of the additional revenue from consumers can be expected to go back to the companies producing the oil.

I would expect these high local oil prices will slightly reduce the world price of crude oil because of the reduced demand from areas using this approach (such as California and Western Europe). Demand will be reduced because oil prices will become unaffordably high for consumers in these areas. These areas are deficient in oil supply, so there will be much less impact on world oil supply.

Refineries in China and India will be happy to take advantage of the lower crude oil prices this approach would seem to provide, so much of the immediately reduced oil consumption in California and Western Europe will go to benefit other parts of the world. But the lower oil world oil prices will also act to inhibit future world oil extraction because the development of new oil fields will tend to be restricted by the lower world oil prices.

The lower crude oil prices will be beneficial in keeping world food price inflation and general inflation down worldwide. Some oil may be left in place, in case better extraction techniques are available later, especially in the areas with these high taxes. With less oil supply available, the economies of California and Western Europe will tend to fail more quickly than otherwise.

Unfortunately, so far, these intentionally higher oil prices for consumers seem to be mostly dead ends; they encourage substitutes, but today’s substitutes don’t work well enough to support modern agriculture and long-distance transportation.

[8] Politicians at times have reduced oil demand, and thus oil prices, by raising interest rates.One way to reduce oil prices has been to push the economy into recession by raising interest rates. When interest rates rise, purchasing power for new cars, and for goods using oil in general, tends to fall. Recession seems to happen, with a lag, as shown on Figure 6. Recessions on this figure are noted with gray bars.

Figure 6. 3-month and 10-year secondary market Treasury interest rates, based on data of Federal Reserve System of St. Louis. The last month shown is July 2025.

Figure 6. 3-month and 10-year secondary market Treasury interest rates, based on data of Federal Reserve System of St. Louis. The last month shown is July 2025.

Increasing interest rates has led to several recessions, including the Great Recession of 2007-2009. A comparison with Figure 1 shows that oil prices have generally fallen during recessions.

[9] The climate change narrative is another way of attempting to reduce oil demand, and thus crude oil prices.The wealthy nations of the world have been spreading the narrative that our most serious problem is climate change. In this narrative, we can help prevent climate change by reducing our fossil fuel usage. This narrative makes trying to work around a fossil fuel shortage a virtue, rather than something that needs to be done to prevent calamity from happening. However, when we examine CO2 emissions (Figure 7), they show that world CO2 emissions from fossil fuels have not fallen because of the climate change narrative.

Figure 7. World CO2 emissions from fossil fuels based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute. Advanced Economies are members of the Organization for Economic Development (OECD). The latest year shown is 2024.

Figure 7. World CO2 emissions from fossil fuels based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute. Advanced Economies are members of the Organization for Economic Development (OECD). The latest year shown is 2024.

Instead, what has happened is that manufacturing has increasingly moved to the less advanced economies of the world. There is a noticeable bump in CO2 emissions starting in 2002, as more coal-based manufacturing spread to China after it joined the World Trade Organization in very late 2021.

The climate change narrative has made it possible to “sell” the need to move away from fossil fuels in a less frightening way than by telling the public that oil and other fossil fuels are running out. However, it hasn’t fixed either the CO2 issue or the declining supply of fossil fuels issue, particularly oil.

[10] The danger is that the world economy is growing increasingly fragile because of long-term changes related to added complexity.Shifting manufacturing overseas only works as long as there is plenty of inexpensive oil to allow long-distance supply lines around the world. Diesel oil and jet fuel are particularly needed. The US extracts a considerable amount of oil, but it tends to be very “light” oil. It is deficient in the long-chain hydrocarbons that are needed for diesel and jet fuel. In fact, the world’s supply of diesel fuel seems to be constrained.

Figure 8. World per capita diesel supply, based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Figure 8. World per capita diesel supply, based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Without enough diesel, there is a need to move manufacturing closer to the end users. But what I have called the Advanced Nations (members of the OECD, including the US, most countries in Europe, and Australia) have, to a significant extent, moved their manufacturing to lower-wage countries. Fossil fuel supplies in countries that have moved their manufacturing offshore tend to be depleted. Trying to move manufacturing back home seems likely to be problematic.

The world economy is now built on a huge amount of debt. All this debt needs to be repaid with interest. But if manufacturing is significantly constrained, there is likely to be a problem repaying this debt, except perhaps in currencies that buy little in the way of physical goods.

When oil supply is stretched, we don’t recognize the symptoms. One symptom is refinery closures in some oil importing areas, such as in California and Britain. This will make future oil supply less available. Other symptoms seem to be higher tariffs (to motivate increased manufacturing near home) and increasing hostility among countries.

[11] Both history and physics suggest that “overshoot and collapse over a period of years” is the outcome we should expect.Pretty much every historical economy has eventually run into difficulties because its population grew too high for available resources. Often, available resources have been depleted, as well. Now, the world economy seems to be headed in this same direction.

The outcome is usually some form of collapse. Sometimes individual economies lose wars with other stronger economies. Sometimes, wage disparities become such huge problems that the poorer citizens become vulnerable to epidemics. At other times, unhappy citizens overthrow their governments. Or, if the option is available, citizens might vote the current political elite out of power.

Such collapses do not happen overnight; they are years in the making. Poorer people start dying off more quickly, even before the economy as a whole collapses. Conflict levels become greater. Debt levels grow. Researchers Turchin and Nefedov tell us that food prices bounce up and down. There is no evidence that they rise to a permanently high level to enable more food to be grown.

Anthropologist Joseph Tainter, in the Collapse of Complex Societies, tells us that there are diminishing returns to added complexity. While economies can temporarily work around overshoot problems with greater complexity, added complexity cannot permanently prevent collapse.

[12] We need to beware of “overly simple” models.The models of economists and of scientists tend to be very simple. They do not consider the complex, interconnected nature of the world economy. In fact, the laws of physics are important in understanding how the world economy operates. Energy in some form (fossil fuel energy, human energy, or energy from the sun) is needed for every component of GDP. If the energy supply somehow becomes restricted, or is very costly to produce, this becomes a huge problem.

As I see it, the supply and demand model of economists is primarily useful in predicting what will happen in the very short term. It doesn’t have enough parts to it to tell us much more.

For any commodity, including oil, storage capacity tends to be very low relative to the amount used each year. Because of this, commodity prices tend to react strongly to any fluctuation in presently available supply, or projected supply in the future. The supply and demand model of economists primarily predicts these short-term outcomes.

For the longer term, we need to look to history and to models that consider the laws of physics. These models seem to suggest that collapse will take place over a period of years, as the more vulnerable parts of the system break off and disappear. Unfortunately, we cannot expect long-term high prices to solve our oil problem.

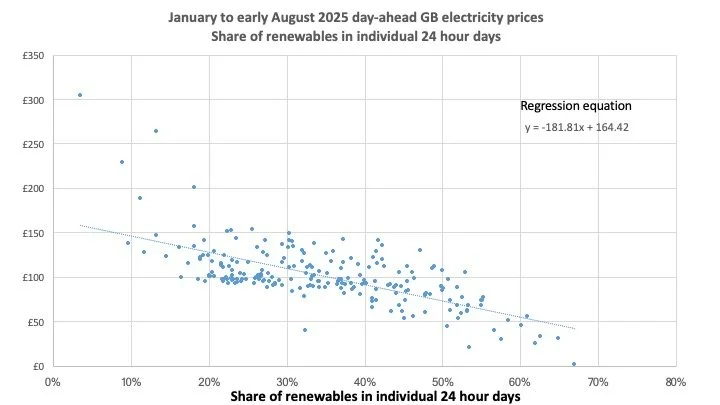

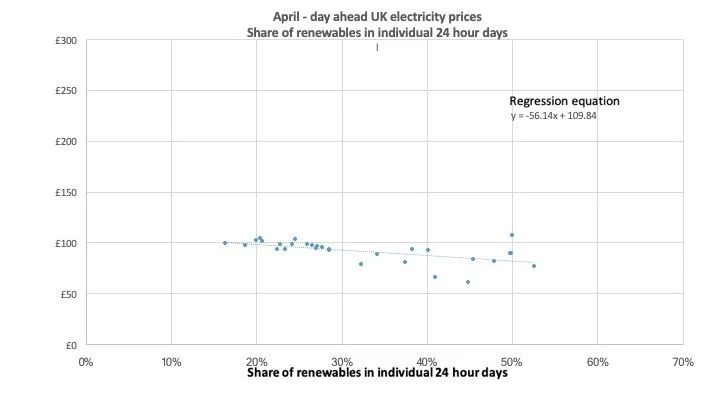

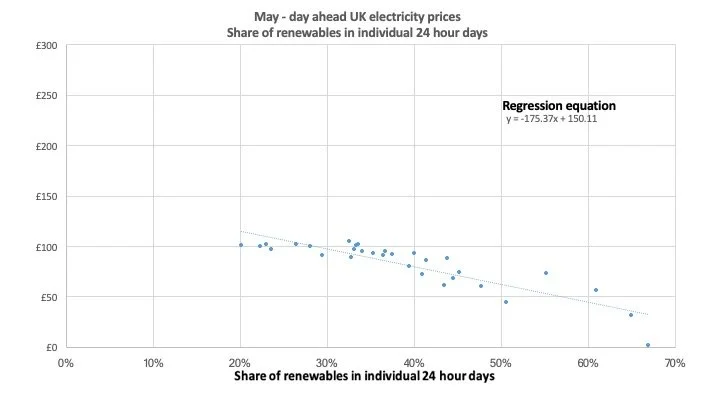

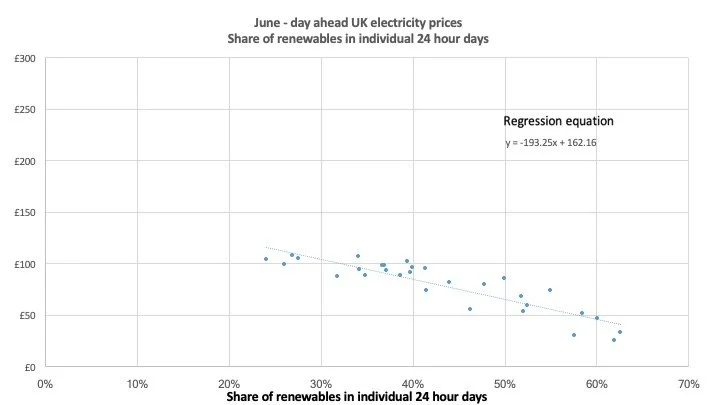

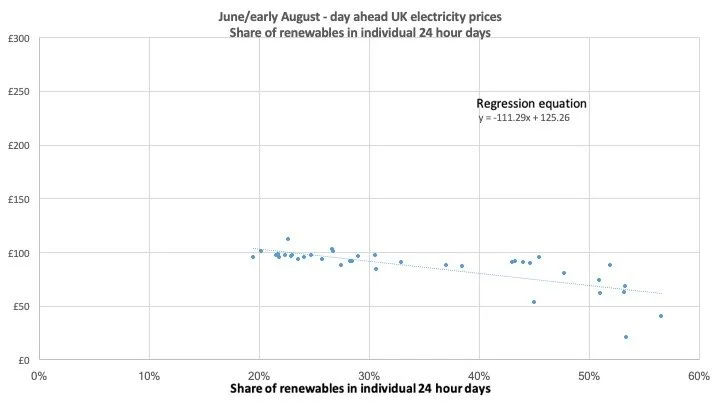

We still hear assertions that adding renewables to the grid has increased the UK's electricity costs. I looked at two sources of data and plotted one against the other to test whether there's any truth in this.

1, The 'next day' electricity price for each hour in the period from 1st January 2025 to the early days of August 2025.[1] That's about 220 days, covering the coldest period of the year and the heat of the summer. (In the UK, electricity prices are highest in the winter and fall to lower levels in the summer because demand is much lower). The source for this data was the research group Ember.

2, The percentage share of wind and solar electricity in total generation in each of the 220 or so days. The source was the GB network operator, NESO.

The analysis seeks to show whether or not days of high electricity price are associated with large or small shares of renewables[2] in total generation. For each day, I plotted the average hourly price of electricity against the share of solar and wind in that day's total electricity generation. If more renewables adds to costs, the price of electricity should be higher when wind and solar are abundant.

Of course that is not the case; a day with wind or sun (or both) typically has a lower hourly average electricity price. And the differences are substantial, as the chart below shows. On average, if modern renewables provided 20% of the electricity in a particular day during this 7 month period, the price would be about £128 per MWh. A 50% day typically resulted in a £73 price, or £55 lower per MWh. A 50% rather than 20% renewables share is associated with a decline of over 40% in the wholesale price in the period I studied.

Figure 1

I have based this estimate on simple linear regression (a 'trendline') [3]. This is an unsophisticated approach, particularly since the chart shows that the correlation between renewables and price may not be properly linear. The visual evidence is that very low renewables shares (experienced mostly in a still January) are associated with particularly high prices that are well above the estimate produced by the regression analysis. In addition, days of very high renewables penetration as seen in the summer months seem to have lower prices than expected. These days sometimes saw wind and solar providing more than 50% of total power generation and prices far below the level projected by the regression line.

Another criticism that might be made of this regression analysis is that mixes months of typically high prices (January to March) with a period of much lower prices (April to August). If the winter had low winds, and the summer had high solar output, the apparent fall in price as a result of high renewables share would actually be caused by inter-seasonal variations, not the direct effect of increased wind and solar.

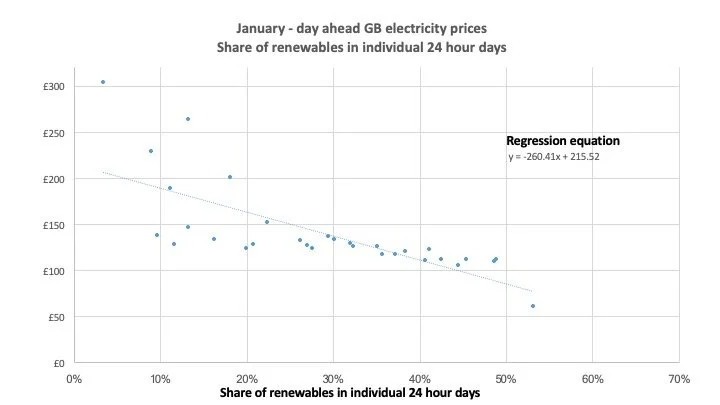

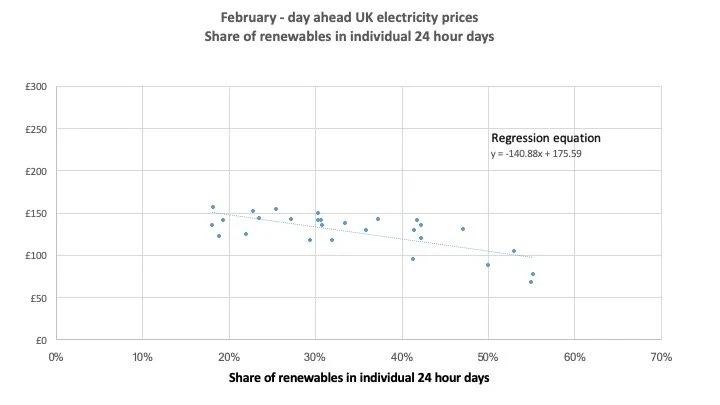

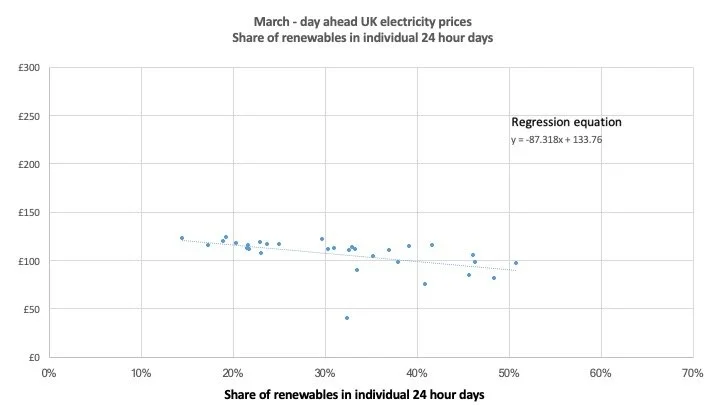

But, very largely, that is not what happened. The following 7 charts examine the relation between wind and solar percentage and the day-ahead price in each month of the period studied. In every month, higher renewables penetration is associated with lower prices. The fall in price as renewables move from 20% to 50% of total generation in each month is generally not quite as large as the main chart suggests but the effect of high wind and solar is still substantial.

In March and April, the fall in wholesale electricity price as a result of a 50% renewables share compared to a 20% share was £29 and £19 per MWh respectively. These were the low months; in May and July the figures were £58 and £64 respectively. January showed the largest effect of of a fall of £87 per MWh resulting from a renewables increase from 20% to 50% of all power production.

More renewables on the GB grid unambiguously reduces the wholesale price, typically by a large percentage. Absent any other effect as the UK continues to add wind and solar, power prices will come down sharply. This is, of course, what we have seen already in many countries around the world.

Figure 2

[1] The 'day ahead' price of electricity is the auction price agreed between suppliers and purchasers of electricity for power to be delivered the following day. I couldn't find an accurate figure but the estimates I came across suggested this market represents about 20% of all wholesale electricity transactions.

[2] I use the word 'renewables' in this note to refer to wind and solar output and do not include hydro or biomass or other low carbon sources of electricity.

[3] The equation for the trendline is shown on each chart. Please contact me for any other details you want.

The Energy Institute recently published its updated energy report, the 2025 Statistical Review of World Energy, showing data through the year 2024. In this post, I identify trends in the new data that I consider worrying. These trends help explain the strange behaviors that we have been seeing from governments recently.

[1] The world’s per capita affordable supply of diesel has been declining, especially since 2014.Because of it is high energy density and ease of storage, diesel is important in many ways:

- Diesel powers a substantial share of modern agricultural equipment.

- Diesel is the fuel of the huge trucks that carry goods of all kinds.

- Diesel powers much of the world’s construction and earth-moving equipment.

- Diesel (and other similarly energy-dense but less refined fuels) allows long-distance transport by ship.

- Diesel is widely used in mining.

- Diesel powers some trains, provides backup electricity generation, and powers some irrigation pumps.

Figure 1. Chart showing the level of per-capita diesel consumption, relative to the per-capita consumption in 1980. Amounts are based on Diesel/Gasoil amounts shown in the “Oil-Regional Consumption” tab of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Figure 1. Chart showing the level of per-capita diesel consumption, relative to the per-capita consumption in 1980. Amounts are based on Diesel/Gasoil amounts shown in the “Oil-Regional Consumption” tab of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Figure 1 suggests that the supply of diesel started being constrained during the 2008-2009 recession. The decrease became more pronounced starting in 2014, which was when oil prices fell (Figure 12). In fact, this downward trend since 2014 continued into 2024. The constraint in diesel production/consumption comes through oil prices that fall too low for the producers of diesel. If prices rise, they don’t stay high for very long.

If there isn’t enough diesel, cutbacks in some applications will be needed. One new workaround for the inadequate supply of diesel seems to be a reduction of international trade through tariffs. If goods can be produced closer to where they are purchased, then perhaps the economic system can accommodate the declining availability of the diesel supply a little longer.

It should be noted that jet fuel consumption is also constrained. The type of oil used is quite similar to diesel. Transferring the transportation of goods from trucks and ships to jet aircraft is not a solution!

[2] Copper supply seems to be constrained.There has been much discussion of transitioning to the use of more electricity and less fossil fuels. This would require both a greater build out of electricity transmission systems and more use of electric cars. Each of these uses would require more use of copper. Electric cars are reported to each require 40kg to 80kg of copper, while cars with internal combustion engines use only 20kg of copper. Building charging stations for all these cars would further add to copper needs, as would adding new transmission lines to carry the higher total electricity supply.

Figure 2. World copper production, based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Figure 2. World copper production, based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Figure 2 shows that even with the expected increase in demand for copper resulting from a shift toward electrification, total world extraction of copper has remained relatively flat. A major issue is that it takes a very long time to build a new copper mine. Worldwide, the average time to new production is 17.9 years. For this reason, a temporary increase in price cannot be expected to drive up production very quickly. If diesel is used in extracting copper, and diesel’s consumption is constrained, the restricted diesel supply can also be an issue in expanding the copper supply.

The new tariffs on copper, announced by President Donald Trump, seem to be intended to drive industries that use copper to look for substitute minerals. With a very long lag, the tariffs might also lead to an increase in copper production. Tariffs have more staying power than volatile price changes. There doesn’t seem to be a quick solution, however.

[3] Platinum extraction also seems to be constrained. Figure 3. World production of platinum and palladium (which is closely related) based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Figure 3. World production of platinum and palladium (which is closely related) based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Platinum currently has a wide variety of applications, including use in catalytic converters, jewelry, medicine, and industry.

Some people are also hopeful that platinum will enable the wide use of hydrogen fuel cells to help meet the world’s demand for electrical power in a way that doesn’t require burning fossil fuels. In fuel cells, platinum acts as a catalyst, enabling the separation of hydrogen and oxygen molecules in water through a chemical process, rather than combustion.

One issue mentioned in the lack of growth in platinum production is persistently low prices. New mines will not be opened unless it is clear that production will be profitable. Another source indicates that the largest producing country, South Africa, has been having problems with electrical supply and rail transportation. These problems, in turn, seem to be related to South Africa’s dwindling coal supply. Its peak coal production took place in 2014. We should not be surprised if South Africa continues to have problems producing platinum in the future.

[4] Up until this report, the Statistical Review of World Energy has used an optimistic approach to quantifying the benefits of intermittent renewable electricity.The traditional method of evaluating energy products involves analyzing the amount of heat produced in combustion. In past years, the Statistical Review of World Energy used a method that essentially assumed that the intermittent electricity produced by renewable sources (including hydropower) completely substitutes for the equivalent dispatchable electricity generated by fossil fuels. I think of this as the “wishful thinking” methodology.

The current methodology gives renewables less credit, recognizing the fact that intermittent sources substitute primarily for the fuel that electricity generating plants would use. It is becoming increasingly clear that intermittent power doesn’t work very well on a stand-alone basis. Many types of workarounds, including batteries and backup fossil-fuel generation, are required to supplement it.

The new methodology gives about 22% more credit to nuclear power than the old method. Nuclear power can be counted on 24 hours per day. Also, like fossil fuel generation, it provides the necessary inertia (the energy stored in large rotating components such as generators, which allows the power system to maintain a steady frequency) to keep electricity moving through transmission lines. Without sufficient inertia, electrical outages similar to that recently experienced in Spain, are likely.

The revised methodology seems to align better with the methods used by the US Energy Information Administration and the International Energy Agency. In the past, it has been confusing with major agencies using different methodologies.

[5] With the new methodology, there are significant changes in patterns from past reports.With the new methodology, the percentage of energy generated directly by fossil fuels is higher than many of us remember from past reports. Now, the portion of fossil fuel consumption that comes directly from fossil fuel generation has been reduced from 94% in 1980 to 87% in 2024. Using the old methodology, the fossil fuel percentage in 2024 would have been 81%.

Figure 4. Fossil fuel energy as share of total energy generation based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Figure 4. Fossil fuel energy as share of total energy generation based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Figure 5 shows the history of non-fossil fuel types of energy, as percentages of total world energy supply. It should be noted that even these types of energy require some use of fossil fuels. Such fuels are used in the initial construction of the devices, for their maintenance, for energy storage, and for transportation (or transmission) to where the energy product is used.

Figure 5. Non-fossil fuels as share of total energy supply based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Figure 5. Non-fossil fuels as share of total energy supply based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute.

Figure 5 shows that the share of energy produced by “Nuclear” hit a peak of 7.6% in 2001, and it has been declining ever since. “Hydroelectric” has grown a bit over the years relative to world energy supply.

“Geo, Biomass, Other” as a share of world energy supply has been relatively flat in recent years. It includes biomass in the form of ethanol and biodiesel, which are non-electricity forms of renewable energy. It also includes electricity from geothermal generation, and from burning wood chips and sawdust.

The only real “winner” in recent years has been “Wind + Solar.” As of 2024, this category amounts to 2.9% of world energy supply. It certainly cannot, by itself, power an economy like the one we have today. Section 7 of this post explains a bit more about this issue.

[6] The sad state of nuclear generation deserves a discussion of its own.There seem to be many factors underlying the substantial decline in nuclear electricity, as a share of total energy supply, between 2001 and 2013:

- There were three major accidents at nuclear power plants, leading to worries about the safety of nuclear generation (Three Mile Island, 1979; Chernobyl, 1986; and Fukushima, 2011).

- The pricing scheme for wind and solar generally gives “priority” to wind and solar. This leads to negative wholesale prices for electricity at some times, and very low prices at other times, for nuclear power plants. This pricing scheme tends to make nuclear power plants unprofitable. I expect that this lack of profitability has been a major issue in the recent decline of nuclear generation.

- There doesn’t seem to be enough uranium produced to support much more nuclear generation than is used today. The US has been using down-cycled nuclear bomb material, but that is now becoming exhausted. See my earlier post.

- Uranium prices never bounce very high for very long. If prices were a lot higher over the long term, more uranium mines might be opened, and more uranium extracted.

- Opening a new mine often involves lag times of 10 to 15 years, making any ramping of uranium production a slow process.